idaho state capital gains tax rate 2021

Taxes capital gains as. However it was struck down in March 2022.

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Individual Income Tax Rate Schedule taxidahogovindrate For years.

. Intangible property like stocks or bonds does not qualify for the capital gains deduction under any circumstances. Everybody else pays either. NerdWallet users get 25 off federal and state filing costs.

The federal government taxes long-term capital gains at the rates of 0 15 and 20 depending on filing status and income. Capital Gains - Idaho State Tax Commission 1 week ago Mar 23 2017 Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

6 days ago 2021 capital gains tax calculator. Page 1 of 2. 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012.

Object Moved This document may be found here. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Your average tax rate is 1198 and your marginal tax rate is 22.

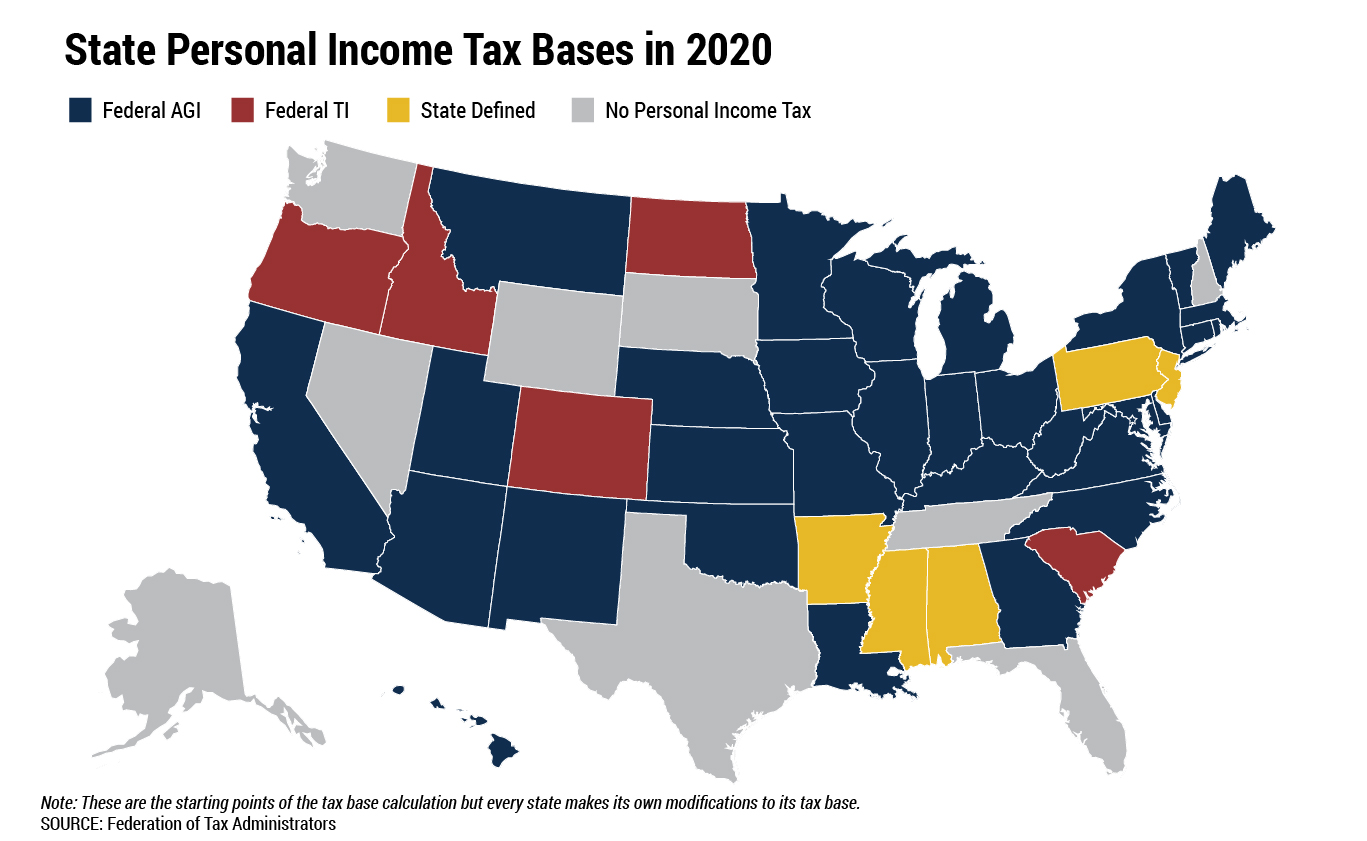

Idahos state sales tax is 6. There is no exclusion for the capital gain tax on the sale of a 2nd home so it depends on your income but for most people the tax will be 15 federal plus. As for the other states capital gains tax rates are as follows.

Capital Gains - Idaho State Tax Commission 1 week. The 2022 state personal income tax brackets are. Jul 23 2022 Level 15.

One important thing to know about Idaho income taxes. You must complete Form CGto compute your Idaho capital gains deduction. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year.

Idaho Income Tax Calculator 2021. The rates are much less onerous. Before the official 2022 Idaho income tax rates are released provisional 2022 tax rates are based on Idahos 2021 income tax brackets.

Many people qualify for a 0 tax rate. Lower tax rates tax rebate. 2022 capital gains tax rates.

The corporate tax rate is now 6. Idaho has reduced its income tax rates. Installment sale isnt eligible for the Idaho capital gains deduction if the.

EFO00093 09-15-2021 Form CG Capital Gains Deduction 2021. For individual income tax the rates range from 1 to 6 and the number of. Long-term capital gains tax rates typically apply if you owned the asset for more than a year.

If you make 70000 a year living in the region of Idaho USA you will be taxed 12366. Capital Gains Tax Rates in Other States. Continue reading The post 2021 Capital.

Idaho State Tax Commission. Idaho Capital Gains Tax Rate 2021 with Ingredients and Nutrition Info cooking tips and meal ideas from top chefs around the world. Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property.

The capital gains tax rate reaches 765. For tax year 2001 only the deduction was increased to 80 of the qualifying capital gain net income.

Idaho Income Tax Rates For 2022

2021 Capital Gains Tax Rates By State

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

State Capital Gains Taxes Where Should You Sell Biglaw Investor

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Idaho Tax Forms And Instructions For 2021 Form 40

Idaho S Poor Pay Larger Share Of Income In Taxes Study Says Idaho Statesman

The High Burden Of State And Federal Capital Gains Tax Rates In The United States Tax Foundation

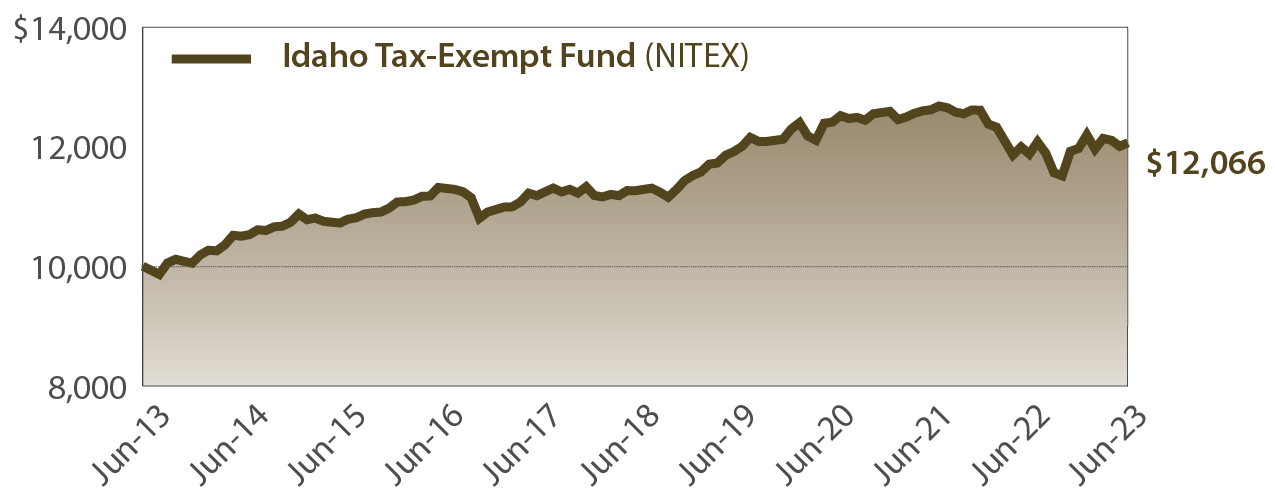

Idaho Tax Exempt Fund Saturna Capital

The High Burden Of State And Federal Capital Gains Tax Rates Tax Foundation

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

The High Burden Of State And Federal Capital Gains Tax Rates In The United States Tax Foundation

Idaho State Taxes 2021 Income And Sales Tax Rates Bankrate

Idaho Remains Fastest Growing State Utah Second Freeaccess Rexburgstandardjournal Com

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

Retirees Aren T Moving To Idaho For Its Taxes Idaho Business Review

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

The High Burden Of State And Federal Capital Gains Taxes Tax Foundation